VIVLA’s Sea‑View 3‑Bed in Santa Eulària: An Investor View

VIVLA’s new‑build 3‑bed apartment in Santa Eulària des Riu balances sea‑view appeal with a EUR 270k entry price—review the investment case, local risks and VIVLA’s service offering.

Nestled in Santa Eulària des Riu, property HQL-XNPRN represents a data‑driven example of how a modern, new‑build coastal apartment can balance rental appeal with sensible acquisition cost for international buyers.

Discovering this Santa Eulària des Riu apartment with VIVLA

This 3‑bedroom, 2‑bath apartment spans 117 sqm and is listed at EUR 270,000. As shown in the photos, the development is new construction with a light, contemporary palette, panoramic sea views and a communal pool—features that materially affect both short‑let appeal and long‑term resale comparables.

How the physical features map to investor priorities

From an investment standpoint, the combination of sea view, terrace, furnished turnkey condition and on‑site pool reduces initial refurbishment and marketing costs—two soft costs that dilute yields. The apartment’s air conditioning and furnished status improve winter and shoulder‑season lettability, while the garden and terrace enlarge usable floor area for tenants without changing gross built area calculations.

- Key features that impact returns: - Sea view: premium to nightly rates and seasonal occupancy. - Communal pool: differentiator against comparable listings. - Furnished & A/C: lowers tenant onboarding costs and vacancy risk. - New construction: lower near‑term capex but monitor resale premium.

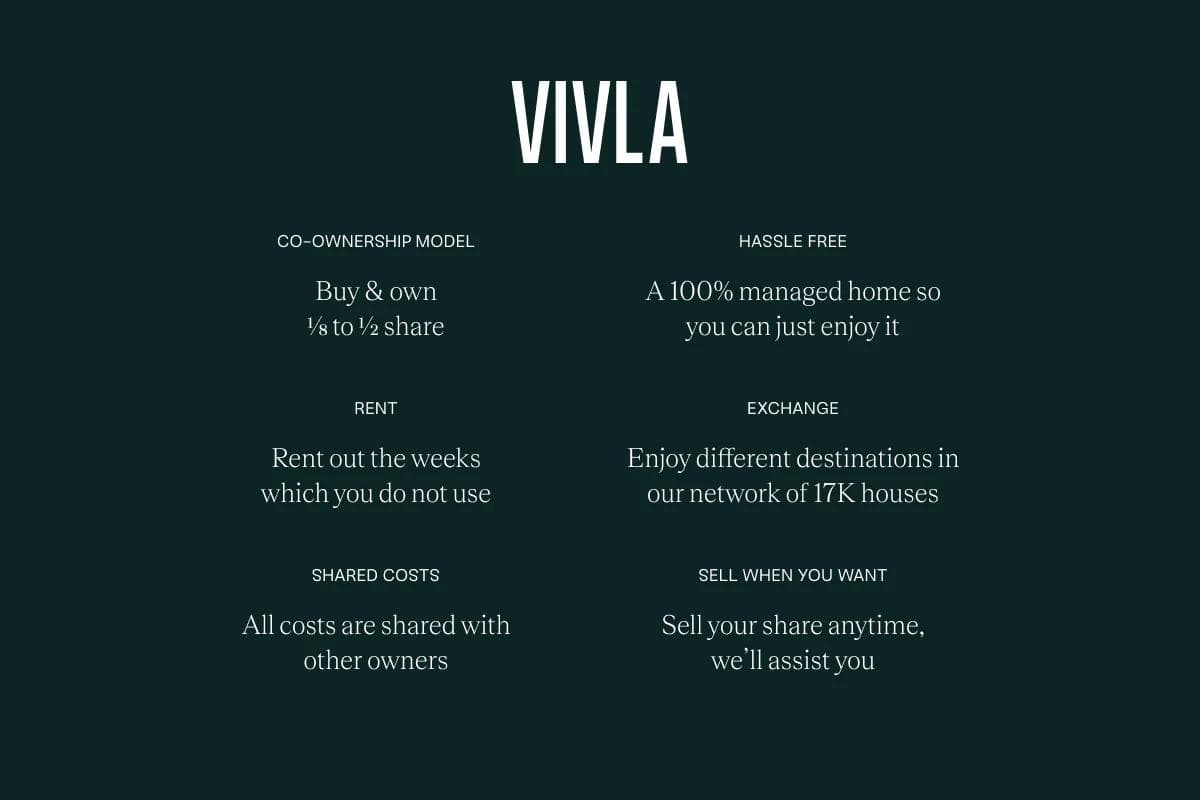

What VIVLA brings to a listing like this

VIVLA, based in Madrid and four years in business, positions itself across luxury, new construction and rental markets. Their model for international clients prioritises local sourcing, professional staging for short‑let channels, and compliance management—three services that directly affect net yield. In practice, VIVLA curated this apartment’s furnished presentation and coordinated the community amenities to be market‑ready, which reduces time‑to‑first‑rental and initial operating losses.

The property images capture the deliberate staging choices: neutral tones, tenant‑ready layouts and photos that show context—pool, terrace and sea lines—that matter when projecting achievable rents. For international buyers who cannot visit frequently, VIVLA’s documentation and photo package are structured to support remote valuation and letting decisions.

Santa Eulària des Riu: market signals to weigh

Santa Eulària des Riu combines authentic Balearic character with steady year‑round demand. For investors, coastal towns on Ibiza show seasonality—high peak yields in summer offset by softer occupancy out of season. Important metrics to model for this location are expected occupancy rates by month, attainable average nightly rate for a three‑bedroom with sea view, and local short‑let regulation which can materially reprice net returns.

- Local factors to include in underwriting: - Seasonality profile: model monthly occupancy, not annualised averages. - Licensing risk: verify short‑let permissions and any local caps. - Operating costs: community fees, utilities, and furnished replacement. - Taxation: non‑resident income tax rules and applicable tourist taxes.

Practical due diligence VIVLA performs (and you should ask for)

VIVLA’s seller pack for this apartment should include construction warranties, energy certificates, community rules, and an itemised operating cost sheet. International buyers benefit from a broker who can provide verified comparables, tenancy roll‑forward scenarios and a conservative rental yield model. Request documented assumptions: expected occupancy by month, management fee schedule, and unit‑level historical or pro forma cashflow.

Questions to ask VIVLA before committing

- Essential queries: - What comparable units underpin the EUR 270k price? - Are short‑let licences confirmed for the complex? - What are typical management and maintenance charges? - Can VIVLA provide a 12‑month pro forma for a furnished three‑bed tenanting?

The investment case and realistic expectations

At EUR 270,000, this apartment sits in a price band accessible to many international buyers seeking exposure to Ibiza without the premium of central town or ultra‑luxury stock. If underwriting for rental yield, be conservative: stress test occupancy by 20–30% below summer peaks and include a 5–8% annualised expense buffer for communal fees and replacement‑level furnishings. Capital appreciation depends on broader Ibiza market cycles—treat this as a mid‑term hold (3–7 years) if you target both income and modest upside.

As shown in the images, unit presentation and location (sea view, terrace) support a higher‑than‑average short‑let ADR; however, that premium must be balanced against regulatory risk and operating overheads. VIVLA’s role is to quantify those trade‑offs and present clear scenario analyses to buyers.

How VIVLA helps international buyers execute

For non‑resident purchasers, VIVLA offers local conveyancing referrals, bilingual documentation, and rental management introductions. Their new‑build relationships also help with warranty transfers and handover processes—reducing transaction friction that commonly delays rental readiness. The agency’s Madrid base gives it national reach while local partners on Ibiza provide neighbourhood‑level intelligence.

What to expect after purchase

- Post‑purchase checklist VIVLA commonly supports: - Utility setup and inventory verification for furnished units. - Professional photography and listing optimisation for short‑lets. - Introduction to vetted property managers and cleaning services. - Annual performance review with updated yield metrics.

The accompanying photo set illustrates the key selling points investors should verify on site: clear sea sightlines from the terrace, pool and garden condition, and the practical flow of the open‑plan living area. Use those images as an inspection checklist when you request further documentation from VIVLA.

Bottom line: who this apartment is right for

This Santa Eulària des Riu three‑bed apartment will suit buyers who prioritise: lower entry cost to Ibiza coastal stock, turnkey rental readiness, and modest upside from location‑specific demand. It is less suited to investors seeking deep value renovations or high‑leverage flips. If your strategy is income with moderate capital growth, this property—presented and managed by VIVLA—warrants a detailed pro forma and regulatory check before offer.

Contact VIVLA to request the complete investor packet: verified comparables, expense schedules, and a conservative three‑scenario cashflow model. For international buyers, those documents convert the photos and floorplans into measurable expectations.

British expat who moved to the Algarve in 2014. Specializes in portfolio-focused analysis, yields, and tax planning for UK buyers investing abroad.

Related Articles

More insights that might interest you